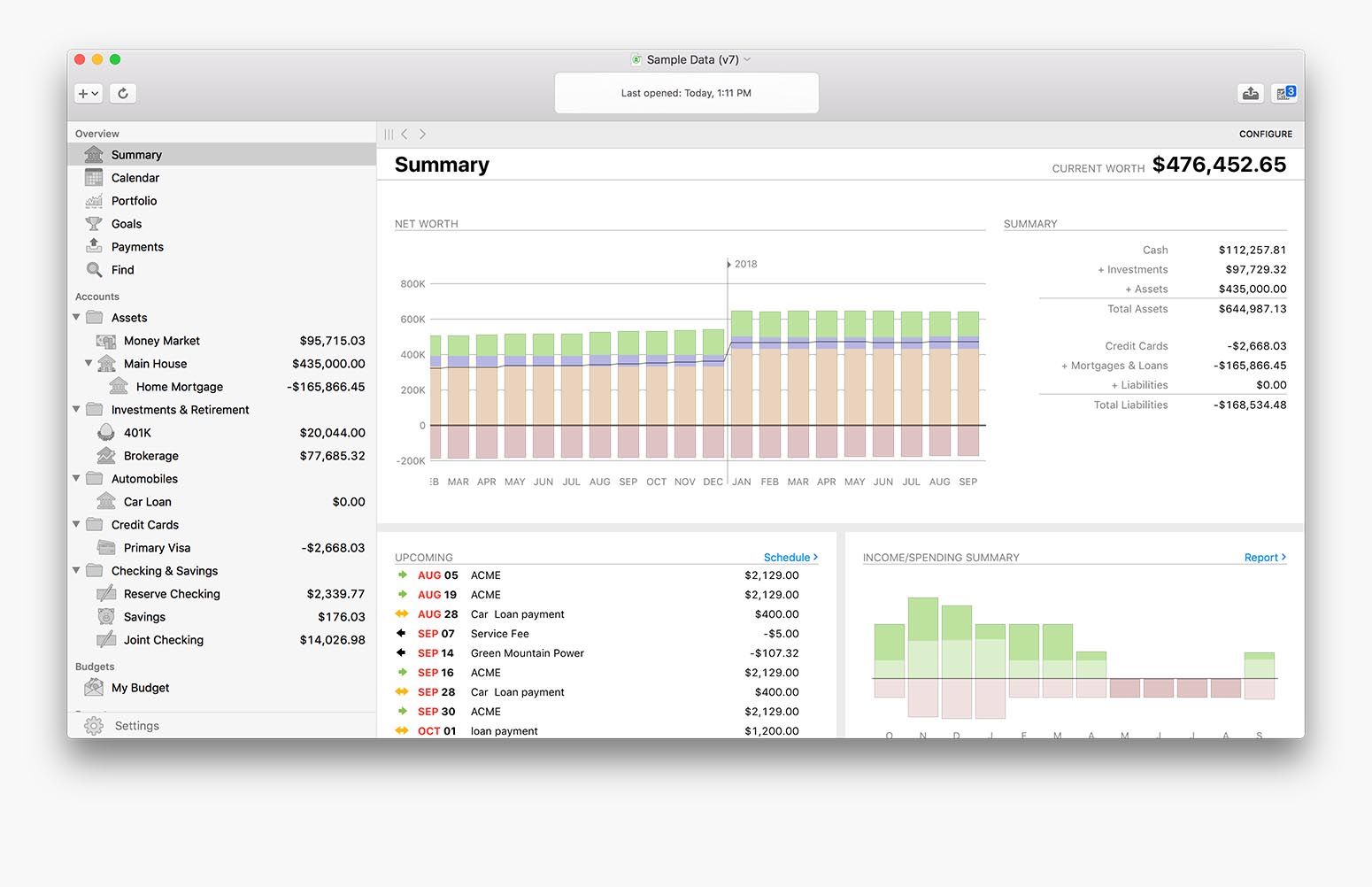

You can even produce custom reports like P&L statements or Cash Flow, all through this extensive piece of software. You can do all of your banking, bill pay and expense tracking from a single app. When you need a full-service finance app, Banktivity fits the bill. It expands to fit your financial situation, offering everything from investment managing to bookkeeping.

#BANKTIVITY REVIEWS FREE#

If you need more power than you’ll find in most free personal finance apps, Banktivity might be exactly what you need. Users love the app, even with the $29.99 price tag. That way those vacation expenses show up in the right bucket. For example, in a standard finance tracking app, every restaurant purchase might show up as a food expense, but what about when you’re on vacation? With Banktivity, you can tag expenses so you have a more clear picture about your spending. Common Banktivity ReviewsĮxperts routinely give Banktivity high ratings (4+ stars) in large part due to the sheer number of features available. With Banktivity, you can work to correct errors and actually reconcile your transactions. Personal Capital has received good reviews on a number of levels, one being that it offers better. Most personal finance apps assume the information on your transaction history is correct, but that’s not always the case. Banktivity, developed specifically for Apple products. For example, you can track your accounts payable as invoices come in if you own a business. You can use it as a complete accounting solution. Where other personal finance apps just present the information from your bank, Banktivity lets you do a lot more. It lacks the goal-tracking and budget alerts that Quicken and Mvelopes offer.

#BANKTIVITY REVIEWS SOFTWARE#

Moneyspire is easy-to-use personal finance software that can help you track your budget, pay your bills and, with its Plus program, keep an eye on your investments. You can also set up accounts to track expenses and deposits for later reconciliation. By Lori Fairbanks published January 04, 2017.

Then, you can start tracking your information. All you need to do is link your accounts to the app, giving it access to your account history. This rates Banktivity higher than its Macintosh competitors, Moneydance and Quicken for Mac. For this version, we have increased the rating to 8.5 stars.

#BANKTIVITY REVIEWS SERIES#

If you have dozens of accounts, own your own business and manage a complex series of investments, your Banktivity account will reflect that. From my extensive testing, I actually like Banktivity enough to perhaps personally use it as a supplement to Personal Capital, which I like using for investment tracking. If your finances are fairly direct and simple, your Banktivity experience will be, too. It all depends on your personal finances. Using Banktivity can be super simple or complicated. It’s a seamless blend of full-service and on-the-go access. It offers all of the functionality you’d expect from a local program with the benefits of instant access and cloud-based storage you get from an app. Banktivity is, no question, one of the most comprehensive and feature-rich options when shopping for a personal finance app.

0 kommentar(er)

0 kommentar(er)